The dictionary defines solvency as “the ability to pay all the money that is owed”. Specific definitions exist in various contexts. A trained financial expert can prepare an analysis (“solvency analysis”) to reach a conclusion of solvency suitable for the context.

Solvency analyses support claims in litigation in state or federal court, or in adversary proceedings (bankruptcy court). Party A accuses Party B of transferring property with the intent to or effect of putting the property out of Party A’s reach. If Party A is correct, then Party B is said to have made a fraudulent transfer, and courts can order Party B to give back the property (or its monetary equivalent) to Party A. Analysts prepare solvency analyses to assess if certain conditions are met to support Party A’s assertions either under the US Bankruptcy Code or state fraudulent transfer laws.

A solvency analysis shares roots with business valuation. In fact, many practitioners, including all CPAs, follow the AICPA’s VS Section 100 professional guidance on valuation engagements when performing solvency work. The conclusion of a solvency analysis is an opinion of the solvency of an entity as of one or more specific dates. In a solvency analysis, the analyst typically performs three solvency tests:

- the balance sheet test

- the cash flow test (also known as the ability-to-pay test)

- the capital adequacy test

The U.S. Bankruptcy Code and state fraudulent transfers laws such as TUFTA include solvency as a condition for causes of action. For example, U.S. Bankruptcy Code 548(a)(1)(B)(ii)(I) defines a transfer as avoidable if the debtor “…was insolvent on the date that such transfer was made or such obligation was incurred, or became insolvent as a result of such transfer or obligation.” U.S. Bankruptcy Code 547(b)(3) also defines a transfer as avoidable if it was “…made while the debtor was insolvent.” Similarly, TUFTA Section 24.006(a) requires that “…the debtor was insolvent at the time or the debtor become insolvent as a result of the transfer…” in defining a fraudulent transfer. The financial expert will not draw any legal conclusions but will instead consult with legal counsel for any required legal assumptions for the cause of action.

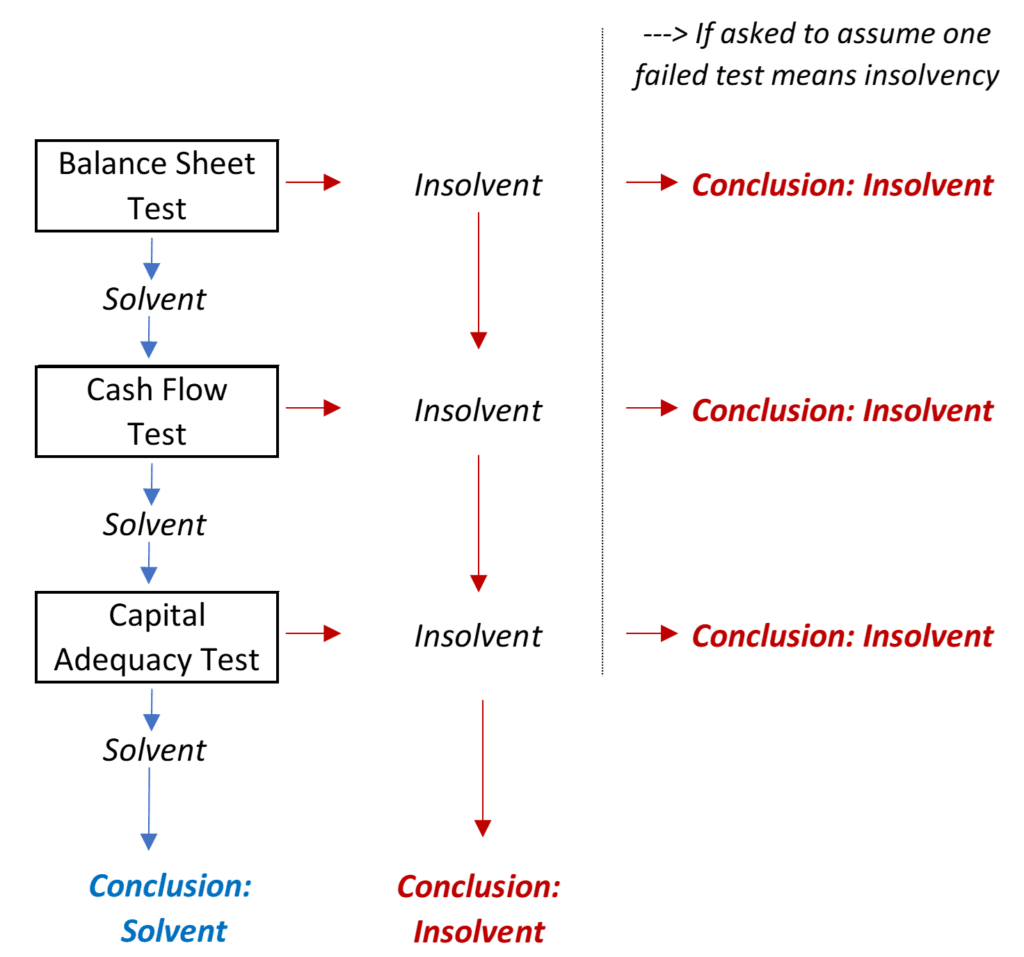

The three solvency tests may produce different indications of solvency. For example, the balance sheet test might deem a company solvent, whereas the cash flow test deems it insolvent. The analyst may be asked to assume that insolvency under any one of the tests results in a conclusion of insolvency.

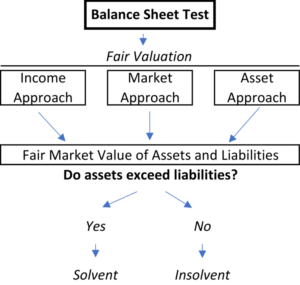

The Balance Sheet Test

The Balance Sheet Test tests whether assets exceed liabilities at “fair valuation”, which is not defined but is usually considered to be fair value or fair market value. The AICPA’s International Glossary of Business Valuation Terms defines fair market value as:

the price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.

The analyst determines fair market value as of the date of each potentially fraudulent transfer. The asset value should be calculated excluding the allegedly fraudulent transfer(s).

The analyst typically considers the income, asset, and market approaches to calculating fair market value for purposes of the balance sheet test. A going-concern premise is usually assumed, though an analyst may also consider liquidation premise. Under the income approach, the analyst often prepares a discounted cash flow (DCF) model. The income approach is also typically applicable to all three solvency tests, providing consistency in the analysis.

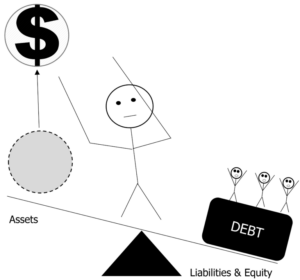

The analyst estimates the values of all the assets, considering both tangible and intangible assets. Third-party specialists can provide values for individual assets such as real estate. Next, the analysist considers all the liabilities, including debt which is typically valued at face value. Then, the value of all the assets is compared to the value of all the liabilities.

If the sum of the liabilities exceeds the sum of the assets, the conclusion of the Balance Sheet Test is insolvency.

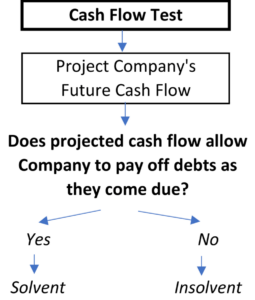

The Cash Flow Test

The Cash Flow Test determines whether a company can pay its debts as they come due. This test, which is also referred to as the ability-to-pay test, is forward looking and requires companies to meet both current and future obligations.

When performing the Cash Flow Test, the analyst forecasts the company’s expected cash flow over a projection period, which is often the longest time period needed for a company’s outstanding debt to mature. On the one hand, the analyst forecasts the sources of available cash flow from i) excess cash on the test date, ii) cash generated during the projection period, and iii) unused lines of credit. On the other hand, the analyst projects the uses of cash in the form of principal and interest debt payments.

The analyst tailors the specific projection techniques to the facts and circumstances of the case. This includes testing the sensitivity of the results to alternative assumptions about the expected cash flows.

If the company cannot pay for its liabilities as they come due, the conclusion of the Cash Flow Test is insolvency.

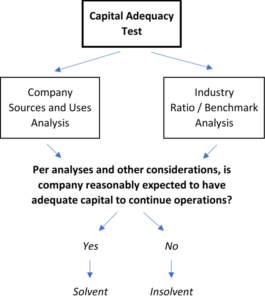

The Capital Adequacy Test

The Capital Adequacy Test determines whether a company has adequate capital to operate the business. There is no bright-line rule for adequacy. Generally, adequate capital means a company can meet its operating expenses, capital expenditure needs, and debt-repayment requirements. To measure adequacy, the analyst typically forecasts sources and uses of funds for a short period following the test date. All operating sources are considered, including access to credit, new equity, and cash flow from operations. The analyst may also consider multiple potential operating scenarios for the company (i.e., best estimate, reasonable favorable and unfavorable variations).

As a separate measurement of capital adequacy, the analyst typically prepares a ratio or benchmark analysis, comparing the company’s results to its industry peers. Per AICPA guidance, “operating ratios, financial ratios, performance indicators, and benchmarks can be used to measure important company attributes such as liquidity, profitability, leverage, and growth. As such, they can be used to highlight trends and allow for comparisons with industry peers”. The analyst relies on industry data from various sources such as the Risk Management Association’s (RMA) Annual Statement Studies.

When analyzing the adequacy of a company’s capital, the analyst may also consider other factors such as whether the company plans to expand its business or continue at its current scale of operations. The AICPA guidance provides a non-exhaustive list of additional factors worth considering. This includes deteriorating bank relationships, worsening accounts payable days outstanding, and physical deterioration of facilities.

If projections show that the company is unlikely to have adequate capital to continue operations, the conclusion of the Capital Adequacy Test is insolvency.

Summary – Conclusion

The analyst prepares the three solvency tests with each test (i.e., balance sheet test, cash flow test, or capital adequacy test) tailored to the facts and circumstances of the specific matter. The analyst may be asked to assume overall insolvency if concluding insolvency on any one of the three tests, as illustrated in the diagram below. If all three tests conclude solvency, then the overall conclusion would be solvency. The analyst’s conclusion of solvency helps assess claims of a fraudulent transfer and quantify damages under litigation and adversary proceedings. Either Party A, the accuser, or Party B, the accused, can benefit from the help of a financial expert.

For additional insight, please contact Rob Sanders, CFA, CFE, APA. He is a Partner at Capstone Forensic Group LLC and routinely assists clients with forensic accounting, financial analysis, calculations of economic losses for businesses and individuals in litigation, and the investigation of suspected fraud. Research and insights for this article were also prepared by Lorene Becker, CPA, CFE.

References and Notes:

- The dictionary definition of solvency can be found at https://dictionary.cambridge.org/us/dictionary/english/solvency. The Bankruptcy Code defines the term “insolvent” in Section 101(32). The Texas Uniform Fraudulent Transfer Act (TUFTA) defines “insolvent” in Section 24.003.

- “Solvency Tests” by J.B. Heaton in The Business Lawyer; Vol. 62, May 2007. Article available at https://ssrn.com/abstract=931026

- A Practical Guide to Bankruptcy Valuation by Dr. Israel Shaked and Robert F. Reilly, 2nd Ed. https://store.abi.org/all-books/a-practical-guide-to-bankruptcy-valuation-second-edition-301.html

- AICPA – Forensic & Valuation Services Practice Aid on Providing Bankruptcy and Reorganization Services, Vol. 2 – Valuation in Bankruptcy (2020)

- The AICPA published non-authoritative guidance for CPAs in a document entitled “Application of VS Section 100 to Various Illustrative Client Engagement Situations” which states that VS Section 100 applies to valuation in bankruptcy litigation. VS Section 100 allows for an exemption from the reporting provisions for valuation work performed in certain controversy proceedings (paragraph .50), but the development provisions still apply.