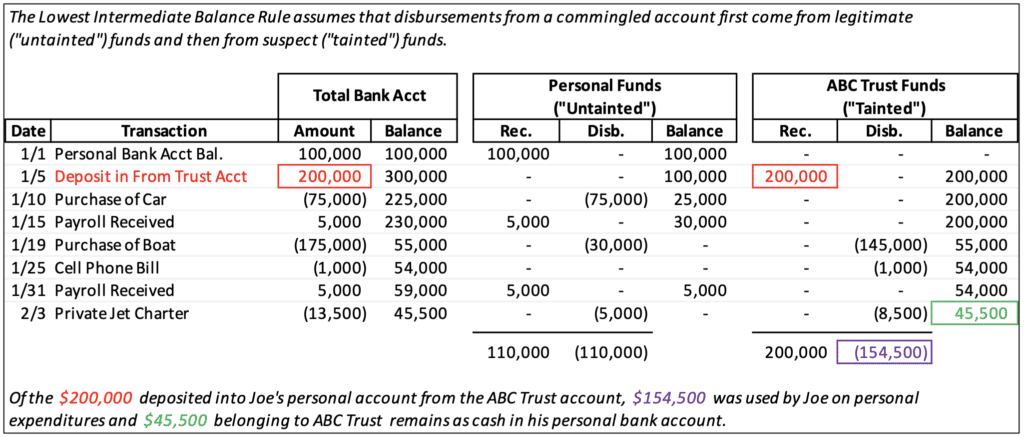

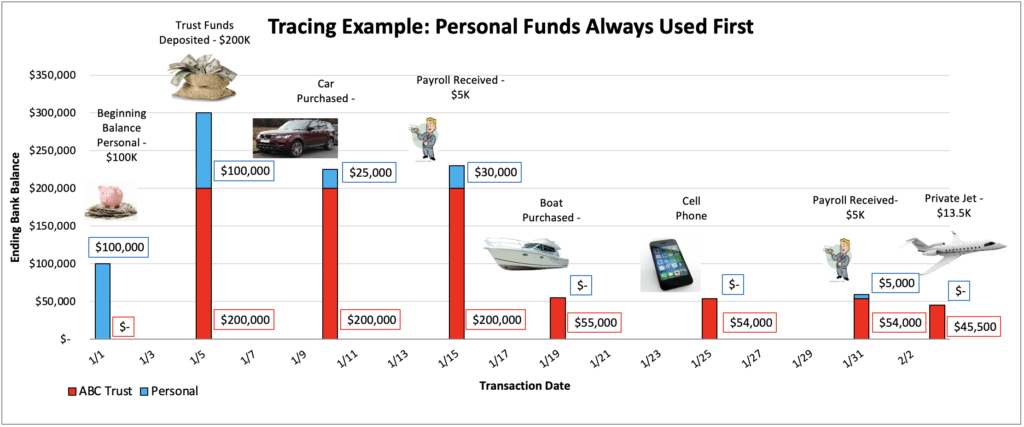

Tracing funds through bank accounts is a complicated exercise, requiring a funds flow assumption. Typically, those commingling their own funds with those not belonging to them are considered to have spent their own funds first, and only then to have begun spending the funds not belonging to them. This is known as the ‘lowest intermediate balance rule.’ Take a look at the graphic below to see how this might look in action.

For example, assume Joe was trustee of the ABC Trust and, without approval, transferred $200,000 of trust funds into his personal bank account on January 5, which already had a balance of $100,000 when the transfer was made. As shown in the graphic above, Joe made several large purchases, but how many of those were made with funds from the trust?

Because Joe is assumed to have used his personal funds first, when he purchased a car (at a cost of $75,000) on January 10, the entire purchase was from personal funds, not trust funds. The trust’s funds weren’t used by Joe until he purchased the boat on January 19. When the boat was purchased, there weren’t enough personal funds left in the account to cover it; therefore, trust funds were used to make up the difference. By February 3, after Joe chartered a private jet, $154,500 was used by Joe on personal expenditures, with $45,500 in cash remaining in his personal bank account.

The $45,500 remaining in Joe’s personal bank account belongs to ABC Trust. In order to recover the remaining $154,500 of trust funds diverted, ABC Trust may be able to use the boat, which was substantially purchased with trust funds.

The lowest intermediate balance rule analysis requires careful tracing of two sets of funds; those owned versus those not owned by the subject. The funds flow assumption uses the owned funds first and the non-owned funds last.