In a stunning collapse reminiscent of Enron, the cryptocurrency exchange FTX, once valued at $32 billion, filed for Chapter 11 bankruptcy on November 17, 2022. The newly appointed CEO, who authorized the Chapter 11 filing and is tasked with maximizing value to FTX’s creditors, was also involved in Enron’s restructuring. And yet, he testified that “never in my career have I seen such an utter failure of corporate controls at every level of an organization, from the lack of financial statements to a complete failure of any internal controls or governance whatsoever.”

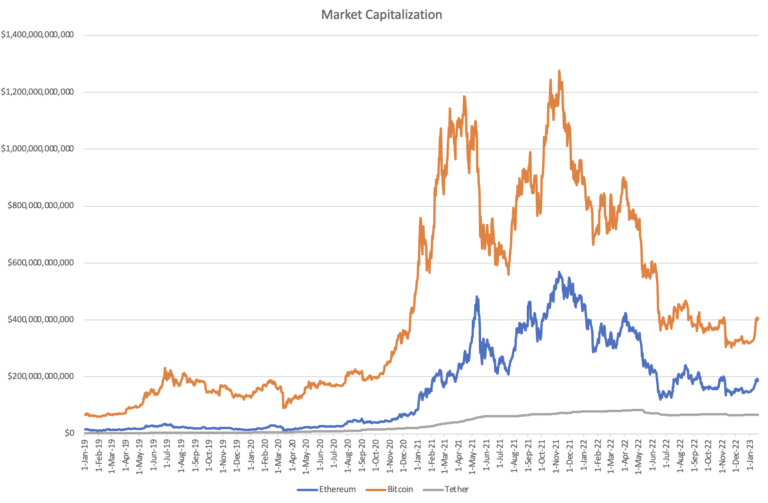

As of November 21, 2022, FTX owed creditors over $3 billion. It faces various allegations of fraud, including transfers of investor funds to related party and hedge fund Alameda Research and the use of investor funds to make personal purchases and large political donations (see: Reuters, DoJ, and CNBC). The global cryptocurrency market capitalization fell from $2.3 trillion at the beginning of 2022 to $829 billion by the end of the year.

Given both a continued consumer interest in cryptocurrency and the rise in cryptocurrency-related fraud and bankruptcy cases in recent media, understanding accounting concepts particular to cryptocurrency is important now and going forward. Crypto is known for its volatility, and given the current lack of uniform federal regulations, we expect to see more cases featuring crypto requiring forensic accounting services.

Cryptocurrency Primer

Cryptocurrency (“crypto”) is a digital medium of exchange which is not managed by a central authority. Cryptocurrency transactions are recorded on the blockchain, a ledger that is shared on multiple computers, so that everyone using the cryptocurrency has their own copy of this “ledger”. Before a transaction is added to the blockchain, it is verified, typically through either proof-of-work or proof-of-stake . The former occurs when computers “mine”, or race each other to solve a math problem, for the reward of cryptocurrency. The latter occurs when individuals \”stake”, or lock, an amount of their cryptocurrency into a communal contract, so that they might be chosen at random (in part based on how much they have staked) to validate transactions.

Most people who are new to crypto or with only limited expertise will access it through one of a number of exchanges, such as Coinbase, Binance, and OKX . These platforms allow investors to buy and trade crypto, using fiat currency or select cryptocurrencies. When choosing an exchange, investors may consider which cryptocurrencies are available to be traded on a given exchange, the volume being traded on the exchange, the types of fees the exchange charges, how the exchange profits from trades, what security measures the exchange has in place (such as storing assets offline), and whether the exchange has insurance against hacking (see NextAdvisor and TIME’s guide to choosing an exchange).

Basics of Cryptocurrency Accounting

Given the rise in the use of cryptocurrency over the last decade, accounting for crypto is a new and complicated topic.

The AICPA has released its 2022 Practice Aid on Accounting for and auditing of digital assets. This aid provides guidance on classifying and measuring an entity’s purchase of crypto assets, defining an investment company and accounting for its digital asset investments, determining the fair value measurement of crypto assets, and accounting for mining pools, among other topics. Per the AICPA Practice Aid, crypto assets with the following characteristics will generally be treated as intangible assets:

- function as a medium of exchange and

- have all the following characteristics:

- They are not issued by a jurisdictional authority (for example, a sovereign government).

- They do not give rise to a contract between the holder and another party.

- They are not considered a security under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The AICPA’s guidance also gives examples of how crypto assets should not be classified:

- Crypto assets will not meet the definition of cash or cash equivalents (as defined in the FASB ASC Master Glossary) when they are not considered legal tender and are not backed by sovereign governments. In addition, these crypto assets typically do not have a maturity date and have traditionally experienced significant price volatility

- Crypto assets will not be financial instruments or financial assets (as defined in the FASB ASC Master Glossary) if they are not cash (see previous discussion) or an ownership interest in an entity and if they do not represent a contractual right to receive cash or another financial instrument.

- Although these crypto assets may be held for sale in the ordinary course of business, they are not tangible assets and therefore may not meet the definition of inventory (as defined in the FASB ASC Master Glossary).

The IRS classifies digital assets as property with respect to federal income tax. This means that crypto transactions often must be reported on a tax return. When you sell cryptocurrency for fiat currency, you must report the capital gain or loss from the transaction. When you receive cryptocurrency in exchange for services, it is considered ordinary income, which is calculated as the fair market value of the crypto in USD on the day it was received and the time at which it was recorded on the blockchain. Per the AICPA guidance, to determine the fair value of cryptocurrency, it should be assumed that a transaction takes place in the principal market (which has the greatest volume and level of activity accessible), or the most advantageous market if no principal market exists.

More Questions?

Stay tuned for upcoming installments on the latest cryptocurrency accounting topics. In future articles, we will go into more depth about what to look for when you’re facing a case involving crypto. Need help with a specific crypto-related accounting issue? Contact us today for a free consultation.